SMM July 20 news: At the 17th SMM International Aluminum Summit - Electrolytic Aluminum and Raw Materials Forum, SMM senior analyst Tian Chen analyzed the operation of the global alumina industry and the future market outlook.

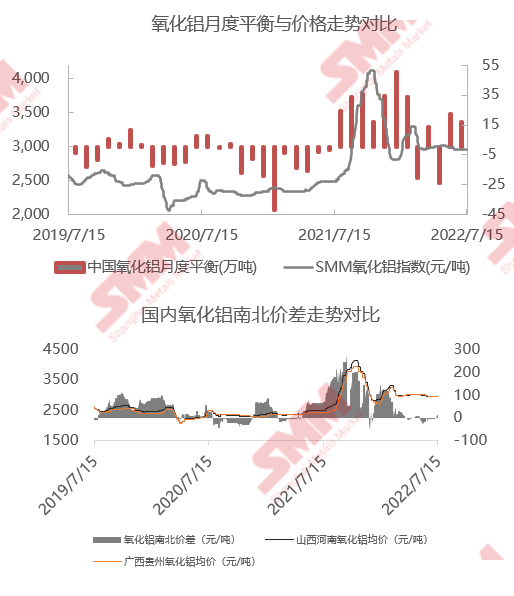

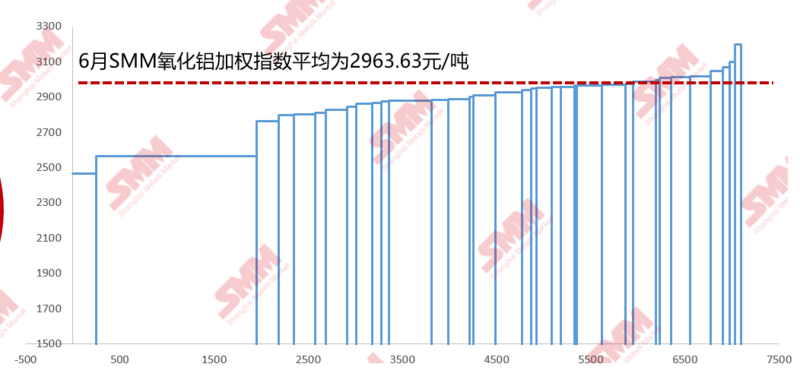

SMM believes that due to the continuation of the pattern of weak external and strong internal, the price trend of alumina at home and abroad has differentiated, and the cost is still high, in addition, with the gradual transformation of the north-south pattern of domestic alumina, the fundamentals have been greatly excessive

The remaining situation may ease, therefore, SMM expects the domestic alumina market price will fluctuate around the cost center.

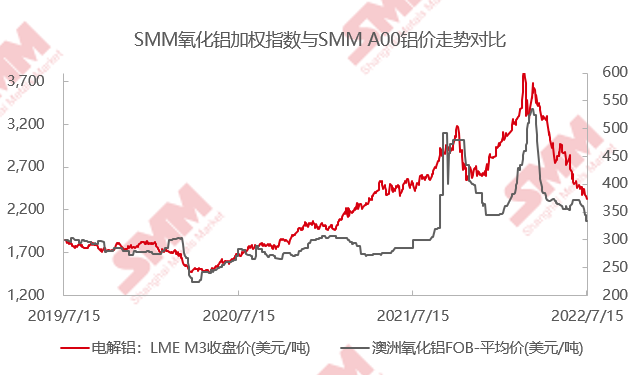

The pattern of external weakness and internal strength continues to deviate from the domestic trend at home and abroad. In the first half of 2022, the spot price of domestic alumina fluctuated greatly. At the beginning of the year, as environmental protection limited production and the impact of the Winter Olympics led to production cuts, alumina prices entered the upward channel.

Then prices fell again in March, falling into a narrow trading pattern. After entering April, the north-south pattern of alumina will gradually reverse from the original north less south more to the north and south are in a tight balance pattern, without considering the situation of imported alumina supplement

In this case, the north and southwest regions can be self-sufficient in alumina. Therefore, under the tight balance pattern of alumina, the price difference between the north and the south will gradually shrink, fluctuating around the cost of various places.

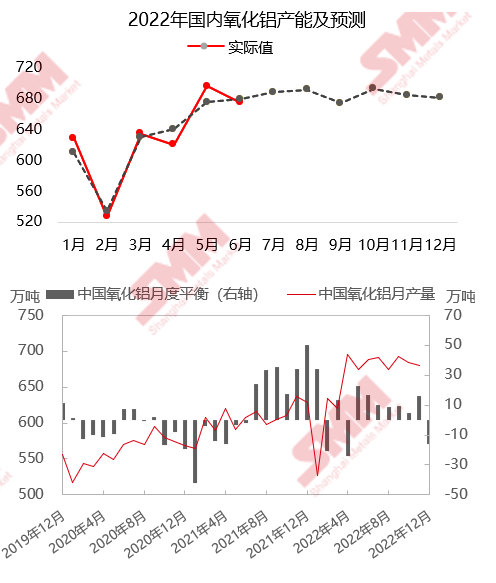

The gradual transformation of the domestic North-South pattern of large surplus fundamentals or will alleviate the overall positive growth of domestic alumina production capacity, according to SMM research data show that as of July 2022, in addition to the capacity that has stopped production and has no resumption plan,

Domestic alumina production capacity reached 94.25 million tons, an increase of 6.4%. According to SMM data show that the current domestic still has 10.127 million tons of excess alumina built capacity, the second half of this year and the next three years, there are still nearly 13.8 million tons

The new investment project is ready to start, and electrolytic aluminum has touched the ceiling capacity, and the domestic alumina can be completely self-sufficient.

Import and export, from January to May alumina imports continued to decline, overseas supply and demand situation and resource flow has changed, on the one hand, the demand for alumina in Europe is stable in China, on the other hand, imported resources and sea freight prices continue to be high,

Superimposed domestic supply increases, downstream profits shrink and other factors, in addition to some just-needed users gradually turn to consumption of domestic resources. From a balance point of view, electrolytic aluminum production has also risen this year, and superimposed alumina will maintain the export rhythm from the second quarter.

It is expected that there will be a small surplus of about 763,000 tons of alumina throughout the year, maintaining a tight balance pattern, and the pessimism of a large surplus of alumina fundamentals has eased slightly.

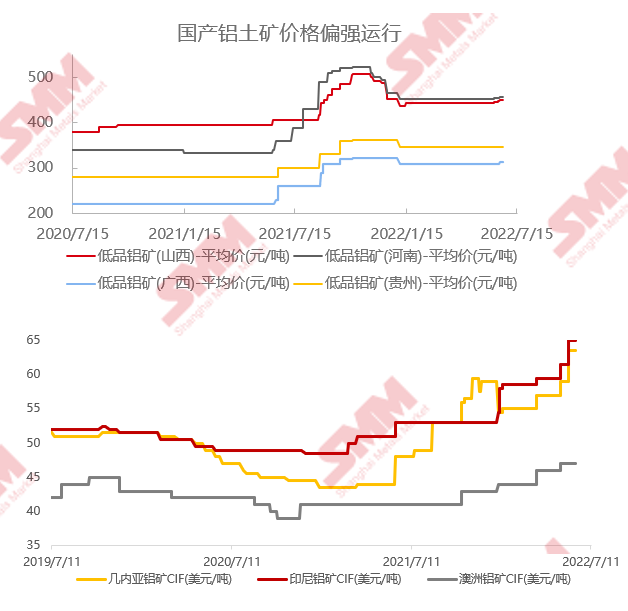

The supply of domestic ore is tight and the cost of importing ore is high

The cost of alumina is divided into five parts: bauxite, caustic soda, energy and other costs. The cost of bauxite accounts for nearly half of the proportion, followed by energy and caustic soda. Since the beginning of this year, the cost of bauxite has remained high, and the cost of caustic soda has continued to rise.

The share of coal costs fell slightly. At present, the domestic supply of bauxite continues to be tight, coupled with the news that Indonesia continues to release the ban on bauxite exports, some domestic enterprises have increased the use of domestic ore. The overall market atmosphere tends to be seller, domestic aluminum

The price of soil and ore is mainly running in a narrow range and strong. In terms of overseas ores, due to the surge in domestic demand for overseas mines and the surge in superimposed sea freight costs, the superimposed factors will also make prices remain high.

In addition, since the second quarter, the domestic liquid alkali price has shown an overall upward trend. Therefore, affected by the overall rise in raw material prices and the low domestic alumina prices, the profits of the domestic alumina industry continued to decline in the first half of this year. The industry as a whole still has

Certain profitability, but the proportion of losses of domestic alumina enterprises has increased significantly, the operating pressure of enterprises is increasing, the high-cost capacity is difficult to operate, and the risk of stopping production is at any time.

Alumina new and old production capacity gradually replaced the price fluctuates around the cost center

The existing new production can press the acceleration key, and the new plant is mostly built around the port, and the purpose is naturally to rely on the advantages of the port and reduce the domestic transportation cost of using imported ore. With such a large scale of new production capacity, high-cost companies will face enormous pressure,

In particular, the cost of Shanxi and Henan is difficult to compete with Shandong, Guangxi and Hebei provinces, and perhaps in the second half of the year, we will see that under the intense competition, high-cost production capacity will gradually withdraw from the historical stage or slowly transfer to the coastal areas. Therefore,

Under the alumina tight balance pattern, the price difference between the north and the south will gradually narrow, and the cost will fluctuate around the place. It is worth noting that it is not only necessary to consider the rate of new investment, as well as the production of electrolytic aluminum, but also the switch of imports and exports as well as the supply and supply of raw materials

Price, and the possible occurrence of black swan events will affect the volatility of alumina prices.

Overseas, with the high overseas energy prices, overseas electrolytic aluminum production reduction led to a reduction in alumina demand, and the release of China's new production capacity, electrolytic aluminum enterprises to import alumina procurement demand transferred from overseas to domestic, China has also changed from a net importer to a net exporter, overseas prices are difficult to find support, is expected to maintain weak operation.

Reprint - Shanghai colored Net